Could it be? Is the Fort Worth real estate market finally starting to cool off? In October 2023, the median home in Fort Worth sold for $330,000, a 2.9% drop from 2022.

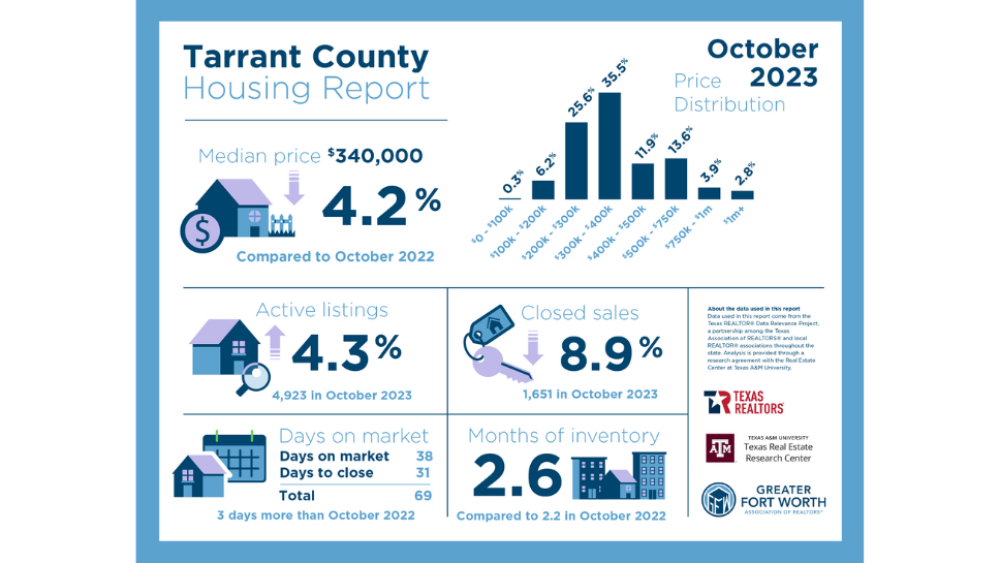

Tarrant County home prices show a few signs of cooling off — particularly with 4.3% more active listings and an average of 40 days on the market (up from 37 days) compared to last year. But for those hoping to dip their toes in the home-buying waters soon, it helps to know what trends to expect. Put on your floaties, and let’s hear what a local expert predicts.

The median home price in Tarrant County has decreased since 2022.

Image courtesy of the Greater Fort Worth Association of Realtors

We’re headed west

Joseph Berkes, of the Joseph Berkes Group – Williams Trew, said that family living is “moving further southwest.” Potentially undervalued neighborhoods that are great for homebuyers include Ridglea Hills, Ridgmar, Mira Vista, and Benbrook.

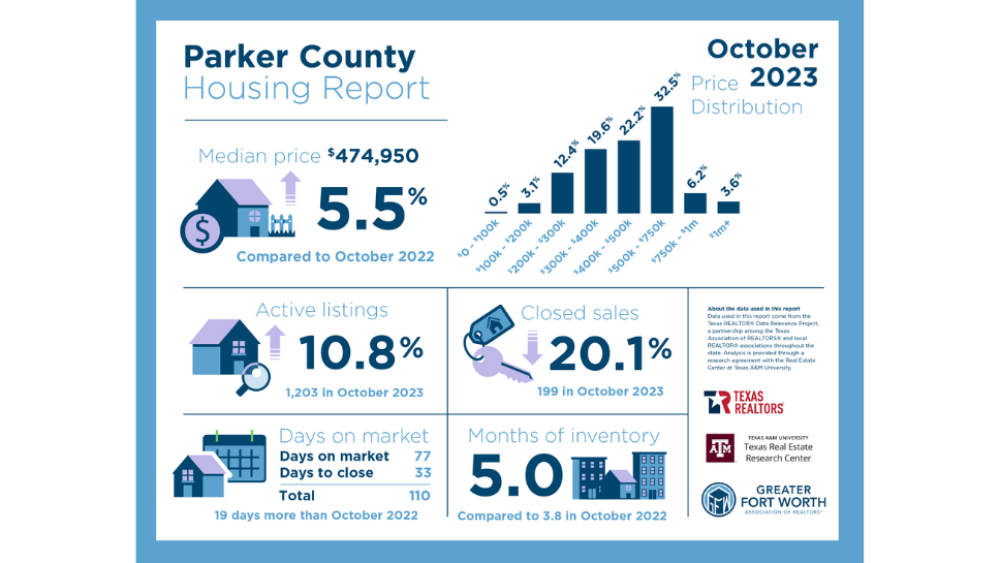

He said he’s even seen a rise in home sales far out in Parker County — like Brock, Millsap, and Weatherford — where the market is still escalating. In October 2023, the median price of a home in Parker County was $474,950, a 5.5% jump year-over-year.

Inside Loop 820, Berkes mentioned the River District, an emerging neighborhood along the West Fork of the Trinity River, as a potential hot spot for young professionals in 2024, citing the neighborhood’s convenient proximity to the urban core.

The median home price in Parker County has increased since 2022.

Image courtesy of the Greater Fort Worth Association of Realtors

Don’t give up on FTW

While the national real estate market can be volatile, Texas generally stays above water. Berkes said he has seen the market “normalize a bit.”

“Growth is still good,” he said. “There are not as many out-of-state buyers as the last few years.

With bigger sales than ever, Berkes noted that Tarrant County is still fairing better the the country as a whole. However, he is no longer seeing as many bids per listing — which jumped up to eight last year — with an average of 2-3 offers on homes for sale.

Worth it to wait?

“People who are practicing patience and are flexible are finding the right houses,” Berkes said, advising homebuyers to work with the seller’s schedule.

He explained that when a listing has multiple offers, sellers are more likely to accept the bid that allows them to stay in their home longer or lease it back.

After a slight decrease in interest rates from 2022, he hopes that rates will come down again and that it will unlock more inventory for buyers. However, he doesn’t expect it to drop down to 3% again — so don’t hold your breath.

In mid-December 2023, the Federal Reserve announced that it would not change its benchmark lending rate in 2024, but it expects to have three rate cuts in 2024 with the first one in March.

What about renting?

According to Berkes, Fort Worth rental homes are scarce and rates keep going up. He has seen more people starting to rent condos and smaller apartments — rather than houses — due to the prices + renting has been a placeholder for buying because the process of purchasing a home has been so drawn out.

A November 2023 analysis by RentCafe set the average rent in Fort Worth at $1,436/month for a 873-sqft apartment. While it’s pretty much the same as November 2022, Cowtown still has lower rates than the national average, which was $1,702/month for 897 sqft as of March 2023.

A deeper analysis revealed that Fort Worth still has a higher cost of living than most of the US.

What’s coming up?

Compared to the last 10 years, Berkes has seen a return to more traditional home styles with maximalist designs and more color — rather than white-box, contemporary trends. He noted that despite a return to in-office work, most homebuyers still want a home office.

Another trend to watch in 2024: Buyers are looking for homes that are move-in-ready + completely remodeled. With the increase in construction costs and timelines, homes that need renovations tend to sit on the market longer.

The supply + demand problem

He also noted that the market “continues to be very tight on supply and have plenty of demand.” He said the luxury end of the market — homes priced above $800,000 — has the lowest supply he’s ever seen.

As for lower- and mid-priced houses, Berkes said there are more on the market and that “lending has gotten better” around affordable housing.

Fort Worth Housing Solutions is helping connect residents with affordable housing options like the upcoming Crestwood Place redevelopment and Cowan Place senior apartments, which are currently accepting applications.

Plus, city leaders recently raised the maximum allowable assistance for first-time homebuyers to $25,000, which increased $5,000 from 2018. Households earning at or below 80% of the area median income — approximately $41,880 annually for a single person — are eligible for assistance.